Steve Sailer writes:

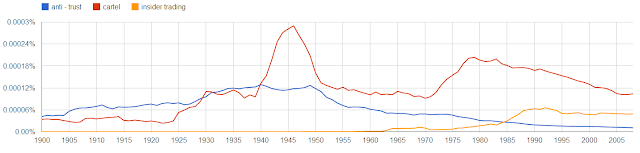

Google's Ngram viewer, which tracks incidents of words, terms, and phrases in books over time, reveals:

Steve nails it (surprise, surprise).

Anecdotally but germanely, I've come across two separate stories today on Mark Cuban's alleged insider trading a decade ago that is said to have netted him $750,000, but this is the first I've heard of an auto-parts price rigging operation with a price tag at least 1,000 times as large.

I'm interested in the topic of cartels and price-fixing, in large part because nobody else seems to be interested in them, which reflects a massive change from as recently as the 1970s.As an early millennial, I remember hearing a bit about the topics in a college macroeconomics class, but that was about it. I do recall a seemingly inordinate amount of focus on insider trading. The latter is a sexier subject because of the soap opera intrigue and bigger-they-are, harder-they-fall story lines it presents media types with, but in terms of inefficiencies and dead weight losses to the larger economy, the former must be more substantial by orders of magnitude.

Google's Ngram viewer, which tracks incidents of words, terms, and phrases in books over time, reveals:

Steve nails it (surprise, surprise).

Anecdotally but germanely, I've come across two separate stories today on Mark Cuban's alleged insider trading a decade ago that is said to have netted him $750,000, but this is the first I've heard of an auto-parts price rigging operation with a price tag at least 1,000 times as large.

0 comments:

Post a Comment